Best Contractor Insurance Plans

Protect your contracting business with essential coverage, mitigating financial risks and ensuring project success.

Understanding Contractor Insurance

If you're a contractor, you know how essential it is to have Contractor Insurance. Not only does it protect your business, but it also safeguards your assets and finances. With the unpredictable nature of contracting work, ensuring you’re covered from risks is crucial in this industry. Without the right plans, a single mishap can cost you a fortune. So, what are the best insurance plans for contractors? Let’s dive in!

General Liability Insurance

One of the most common types of coverage for contractors is General Liability Insurance. This policy protects you against claims for bodily injury, property damage, and personal injury that you or your employees might cause while working on a project. In a field that involves heavy machinery, materials, and public interaction, having this insurance is essential. It not only builds your credibility with clients but also provides peace of mind knowing you’re covered against unexpected accidents.

Workers Compensation Insurance

As a contractor, your employees are your most valuable assets. That’s why Workers Compensation Insurance is non-negotiable. If a worker gets injured on the job, this insurance covers medical expenses and lost wages. Moreover, it keeps you compliant with state laws, which often mandate this coverage. Investing in your workforce's safety means investing in the longevity of your business.

Commercial Auto Insurance

If your work requires driving, don’t overlook Commercial Auto Insurance. This policy covers vehicles used for business purposes, ensuring you’re protected in case of accidents, theft, or other incidents on the road. Whether you’re transporting materials or heading to job sites, having this insurance is critical for your peace of mind and financial security.

Professional Liability Insurance

Mistakes happen, and when they do, Professional Liability Insurance comes to the rescue. This type of coverage protects you from lawsuits claiming negligence, errors, or omissions in the services you provide. It’s particularly vital for contractors involved in consulting or advising roles, as clients can hold you responsible for financial losses stemming from your work. Don't let a small oversight turn into a big problem; protect yourself with this essential insurance.

Surety Bond

While not conventional insurance, a Surety Bond is vital for contractors, especially in construction. It guarantees that you will complete a project as agreed. If you don’t deliver, the bond gives clients a form of recourse. It enhances your credibility and is often required to obtain contracts. Think of it as a safety net that ensures clients can trust you to fulfill your obligations.

Business Owners Policy

A Business Owners Policy (BOP) bundles multiple insurance types into one convenient package. Typically, it includes general liability and property insurance at a lower premium than purchasing them separately. This option is fantastic for small to medium-sized contractors looking for cost-effective coverage that addresses various risks in one go. Saving money while ensuring you’re adequately insured? Count us in!

Builder's Risk Insurance

If you’re involved in construction, you can’t overlook Builder's Risk Insurance. This insurance covers buildings under construction against damages due to fire, vandalism, or certain weather events. It’s crucial to protect your investment during the building phase, as any delays or damages can skyrocket project costs. Always ensure you have this coverage in place before starting any new projects.

Equipment Breakdown Insurance

For contractors relying on equipment and machinery, Equipment Breakdown Insurance is a lifesaver. This policy provides coverage for the repair or replacement of equipment that breaks down due to mechanical failure or accidents. Unexpected equipment failures can halt a project and dramatically increase costs, so having this insurance helps you keep things running smoothly.

Cyber Liability Insurance

In the digital age, contractors must consider the importance of data protection through Cyber Liability Insurance. This insurance protects against the fallout from data breaches, hacking incidents, and other cyber threats. Securing sensitive client information is essential, and this coverage can help mitigate costs associated with a cyber-attack, ensuring your company remains robust in the face of modern risks.

Excess Liability Insurance

When your regular policies fall short, Excess Liability Insurance kicks in. It provides an additional layer of coverage beyond what your standard liability insurance offers. For contractors working on high-stakes projects, this can be crucial. Think of it as an insurance policy for your insurance, allowing you to tackle larger projects without the looming fear of exceeding your coverage limits.

Umbrella Insurance

Now, let’s take a look at Umbrella Insurance, a vital yet often misunderstood component of contractor insurance plans. This extra layer of liability coverage extends beyond the limits of your other policies, such as general liability and auto insurance. If you face a lawsuit that exceeds your coverage limits, umbrella insurance covers the rest. It’s a security blanket that every smart contractor should consider to safeguard their business assets.

Why You Need Umbrella Insurance

The landscape of contractor work can be unpredictable, with risks lurking around every corner. Accidents happen, and it’s how you manage the fallout that often determines if your business will recover. That's where Umbrella Insurance plays a critical role. Imagine facing a hefty lawsuit for a work-related incident – without it, you might find yourself sinking under debt. With umbrella insurance, your financial future remains secure.

Choosing the Right Insurance Plan

Finding the best insurance solutions can feel overwhelming, but it doesn’t have to be. Assess your construction business's specific needs, and consider talking to a specialized insurance agent who understands the contractor world. Ensure you get the right combination of insurance coverages tailored for your operations. Each region has unique risk factors, so don't hesitate to ask questions.

Additional Resources and Maintenance

Staying updated on insurance trends and coverage options is crucial. Regularly assess your insurance needs as your business evolves. Keep an eye on innovative policies and coverage that can better protect you. For an in-depth look at various coverage options, visit this resource to explore what’s available.

Conclusion

In conclusion, investing in the best contractor insurance plans is not just a safety net but a fundamental step in securing the future of your business. By understanding and leveraging various types of coverage—including Contractor Insurance, General Liability Insurance, Workers Compensation Insurance, and that essential layer of protection from Umbrella Insurance—you can navigate the complexities of being a contractor with confidence. The right plans will afford you the peace of mind you need to focus on your work rather than worrying about unforeseen setbacks. For tailored advice on what your business needs, take a look at this insightful guide. Plan smart, stay protected!

Posts Relacionados

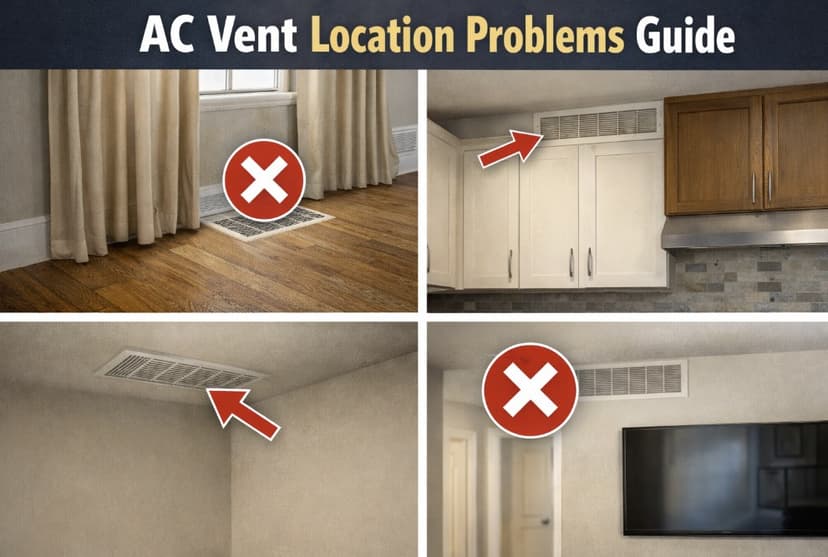

Ac Vent Location Problems Guide

Improper placement causes uneven temperatures, poor airflow, and reduced energy efficiency. Identify these issues for optimal comfort.

Air Return Placement Common Mistakes And Tips

Improper placement causes poor airflow, energy waste, and discomfort; avoid these mistakes for optimal HVAC performance.

Choosing The Right Smart Security Overview

Selecting the best smart security system means evaluating features, assessing needs, and ensuring reliable home protection.