Burial Insurance For Seniors A Guide

Planning ahead offers peace of mind. Coverage helps with funeral costs, easing financial burdens for loved ones.

Understanding Burial Insurance For Seniors

As we age, it's essential to think about what happens to us after we pass away. One critical aspect of this consideration is Burial Insurance For Seniors. This type of insurance ensures that your loved ones won't be burdened with the hefty costs of funeral expenses. With various options available, it can often be overwhelming to navigate these waters, but we're here to help simplify the process.

What is Final Expense Insurance?

Final Expense Insurance is a subset of burial insurance, specifically designed to cover funeral costs and other associated expenses such as medical bills. This type of insurance provides peace of mind, ensuring that your family won’t face financial difficulties during an already challenging time. The benefits and structures may vary from one policy to another, so it’s wise to compare different options to find what works for you.

Pre Need Funeral Planning - Why It Matters

Engaging in Pre Need Funeral Planning allows you to take control of your funeral arrangements in advance. This can prevent emotional stress for your family members. Plus, having a plan in place often means lower costs in the long run. Many burial insurance policies will incorporate this element, providing an opportunity to discuss your wishes and decide on costs before they escalate.

Senior Life Insurance and Its Role

Senior Life Insurance is another umbrella term that includes various policies aimed at older adults. It generally encompasses whole and term life insurance as well as burial insurance. The main difference is that life insurance can cover a broader range of expenses, while burial insurance specifically targets end-of-life costs.

Understanding Funeral Insurance

Often used interchangeably with burial insurance, Funeral Insurance can include various types of policies aimed at covering funeral expenses. It's crucial to read the policy details carefully to avoid any unexpected out-of-pocket costs. Many seniors find these policies comforting as it ensures financial safety for their families.

Finding Affordable Burial Insurance

When looking for Affordable Burial Insurance, it may seem daunting, but plenty of options are available. The key is to do thorough research and obtain Burial Insurance Quotes from multiple providers. Look for policies that offer flexibility and affordability without compromising coverage. Your financial future and that of your family can thrive with a little diligence!

Finding the Best Burial Insurance

The quest for the Best Burial Insurance often leads many to consider not only the cost but also the benefits and limitations of various policies. Reading reviews, consulting with insurance professionals, and comparing costs can reveal a lot. It's crucial to choose a policy that doesn’t just seem appealing on the surface but one that also aligns with your specific needs.

Low Cost Burial Insurance Options

Options for Low Cost Burial Insurance are abundant and can be very attractive for seniors on a budget. Many operate under the premise that you're paying in smaller increments for long-term security. While it's tempting to go for the cheapest option, ensure that it covers your needs adequately to avoid future complications.

Whole Life Insurance vs. Term Life Insurance

Understanding the distinction between Whole Life Insurance and Term Life Insurance is vital. Whole life offers coverage for the duration of your life and can accumulate cash value, while term is solely focused on covering a specified period. For burial purposes, many prefer whole life for its benefits in ensuring family security.

Medicaid Burial Fund - What You Need To Know

For those who rely on government assistance, the Medicaid Burial Fund is an option that can help set aside a certain amount of money for burial expenses without affecting eligibility for Medicaid. It’s essential to understand your state’s specific regulations as they can vary significantly. Learning about these funds can ease some financial burdens and ensure that you or your loved ones are cared for after your passing.

How to Obtain Burial Insurance Quotes

Getting Burial Insurance Quotes is relatively easy in today’s digital world. Most companies allow you to obtain these quotes online within minutes. Be prepared to provide information regarding your age, health background, and the type of policy you're interested in. Comparison sites can be especially helpful for this process.

Conclusion: Choosing the Right Policy for Your Needs

When it comes to planning for the inevitable, the significance of Burial Insurance For Seniors cannot be overstated. From understanding Final Expense Insurance to considering Affordable Burial Insurance, each of these pieces plays a crucial role in your planning. Take your time, do your research, and consult experts when necessary. Ultimately, it’s about peace of mind for both you and your loved ones.

For more detailed insights, check out these articles: Burial Insurance Guide and Understanding Burial Insurance Policies.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

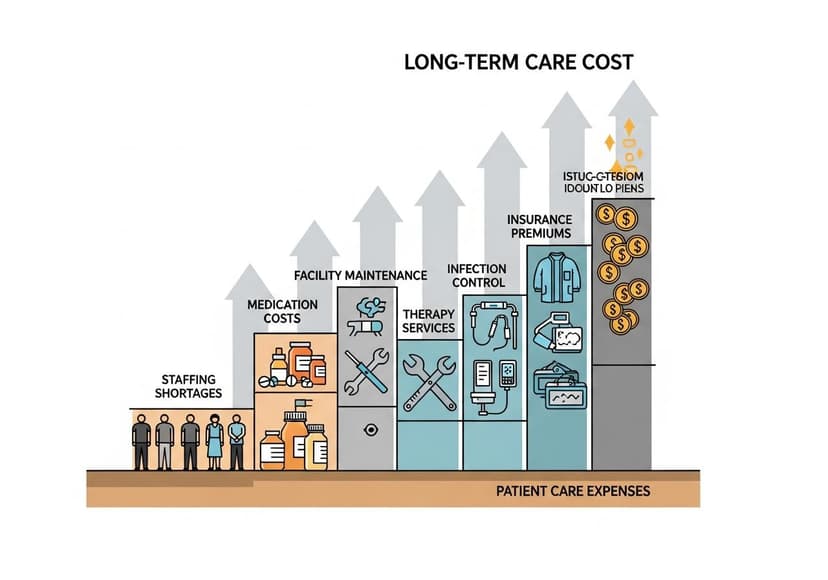

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.