Burial Insurance Plans For Seniors

Secure your final arrangements with affordable coverage, ensuring peace of mind for you and your family.

When we think about the future, it’s important to plan not just for holidays and retirement, but also for those unexpected events, including the costs that come with death. One way to ease the burden on your loved ones is through Burial Insurance, also known as Final Expense Insurance. This insurance type is designed specifically to cover funeral expenses, ensuring your family doesn’t have to worry about the financial aspects during a difficult time.

What Is Burial Insurance?

Burial insurance provides a way to cover your funeral costs and other final expenses. It can be a type of Whole Life Insurance policy that accumulates cash value over time. But perhaps the most appealing aspect of these policies is their affordability. Many seniors find Affordable Burial Insurance plans that fit within their budget without significant strain.

Why Consider Final Expense Insurance?

The main goal of Final Expense Insurance is to alleviate the financial burden on loved ones. Funerals can be surprisingly costly, with average expenses exceeding $7,000. By investing in such plans early, you can lock in lower rates and ensure peace of mind, knowing that your family won't be left scrambling to gather funds for your funeral expenses.

The Benefits of Senior Life Insurance

When exploring insurance options, Senior Life Insurance policies are tailored for older individuals. They usually have simplified underwriting processes and may not require a medical exam. This makes them accessible and practical for seniors looking for coverage without the complexities associated with traditional life insurance.

Understanding Pre-need Insurance

Pre-need Insurance differs from burial insurance in that it allows you to plan your funeral in advance. You secure a policy that directly covers your future funeral costs, making decisions about your service, casket, and burial location upfront. This insurance ensures your wishes are followed and can also lock in current prices, a boon in times of rising costs.

Funeral Insurance: A Helpful Plan

Funeral Insurance specifically addresses the costs of burial and related services. Like other burial policies, it ensures that as you age, your family won’t be left with unanticipated bills. Many plans allow you to pay in installments alongside affordable rates, making it an economical choice for those looking to plan ahead.

What Is Life Insurance For Seniors?

Life Insurance For Seniors encompasses several policies, including burial insurance. These plans may provide multiple benefits, such as cash value accumulation and death benefits, which can be significant for your family during an emotionally taxing time.

How to Get Burial Insurance Quotes

Intrigued by the notion of burial insurance? The first step in your journey is to gather Burial Insurance Quotes. This process can seem daunting, but there are numerous online resources that make it easy to compare policies side-by-side. Many companies offer free quotes tailored to your unique needs, which can guide your decision-making process.

Finding the Best Burial Insurance

With multiple options available, finding the Best Burial Insurance for your needs requires a bit of research. Look for insurers with good reputations, compare their policy details and coverage, and read reviews from other customers. Sites like this one can help you in making informed decisions.

Typical Burial Plans and Their Costs

When searching for Burial Plans, consider what specific services they cover. Different policies may include varying services such as casket costs, use of a funeral home, transportation fees, and more. By understanding what is included, you can accurately assess the potential financial impact on your loved ones and decide accordingly.

Covering Funeral Expenses: Personal Preparation

Ultimately, preparing for funeral expenses doesn’t just benefit your relatives; it allows you to take charge of how your life will be honored. By purchasing burial insurance, you foster a sense of control over your final wishes, which can be liberating and relieve a lot of anxiety about the future.

Things to Consider Before Purchasing

Before signing any policy, there are crucial considerations you should bear in mind. Evaluate the policy limits, potential exclusions, the insurer’s financial stability, and customer satisfaction ratings. Tools like this guide can lead you through the maze of options available.

Real-Life Scenarios of How Insurance Can Help

Consider these scenarios: a loved one passes unexpectedly without any plans in place, leading to family scrambling for funds to cover the expenses. Conversely, if a family member has planned ahead with a solid burial insurance policy, loved ones can focus on grieving rather than worrying about financial burdens. It's a powerful testament to the peace of mind that this coverage can provide.

Leveraging Benefits of Final Expense Policies

Take full advantage of your Final Expense Policies by ensuring that all beneficiaries and family members are aware of the arrangements you've made. Communication is key when it comes to executing the plans you've laid out. Planning your funeral can make it easier for your family when the time comes, aligning the expectations with your shared values and desires.

Additional Resources for Seniors

Being well-informed is vital. Don’t hesitate to explore external resources that can provide further insights into burial insurance. Research articles, personal finance websites, and even seminars conducted at local senior centers can all aid in your understanding of the options available to you. One example is this informative article, which covers essential details regarding burial insurance.

Final Thoughts on Burial Insurance

In conclusion, investing in burial insurance is not just a financial decision; it’s a nurturing act towards your family. With various types of plans available, seniors have more avenues than ever to explore affordable options that meet their needs. By taking action today, you pave the way for a more secure tomorrow, making sure that your family is not left to shoulder the burden of unexpected costs during a time of grief.

So, take the initiative today, educate yourself and your family on burial insurance options, and ensure you have a plan in place. It’s a small step that can lead to significant comfort for you and your loved ones.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

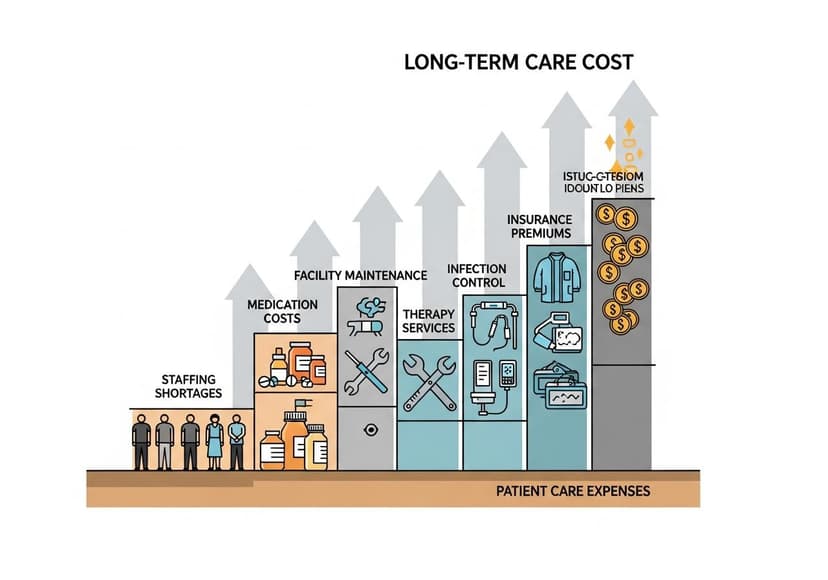

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.