Choosing A Medicare Advantage Plan

Compare Medicare Advantage plans, considering costs, coverage, and provider networks to meet your healthcare needs.

As you approach retirement age, one of the most important considerations you’ll face is choosing the right health coverage. With the complexities of Medicare and various health plans available, it can feel overwhelming. This guide is designed to help you navigate the intricacies of Medicare Advantage Plans, ensuring you make an informed decision that best fits your healthcare needs and budget.

Understanding Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though some younger people with disabilities may also qualify. The program consists of different parts: Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage), and Part D (Prescription Drug Coverage). Many seniors often find themselves asking, “What’s the best option for me?” Understanding the differences between these plans is crucial.

What are Medicare Advantage Plans?

Medicare Advantage Plans are a type of health plan that private insurance companies offer to provide Medicare benefits. They include all the coverage of Original Medicare (Parts A and B) and often include additional benefits, such as dental, vision, and hearing coverage. These plans are typically designed to provide a more comprehensive approach to senior health plans, combining the coverage you need into one convenient package.

Why Choose a Medicare Advantage Plan?

Many individuals opt for Medicare Advantage due to its comprehensive nature. They can often offer lower out-of-pocket costs, additional coverage options, and a simpler navigation process compared to Original Medicare. However, not all Medicare Advantage Plans are created equal. It's important to review the options available in your area to determine which plans offer the best Medicare benefits that fit your lifestyle and healthcare needs.

Assessing Your Healthcare Needs

Before diving into your options, take stock of your current medical needs. Consider how often you visit the doctor, whether you take prescription medications, and what specialists you see. Evaluating your healthcare needs can dramatically influence which Medicare Plans would be the most suitable for you. Some plans might be more beneficial for those who require specialized treatments or regular doctor visits.

Costs Associated with Medicare Advantage Plans

Cost is a significant factor when choosing a health plan. Medicare Advantage Plans come with a monthly premium, but many plans have zero premiums. It’s essential to consider not just the premium but also other costs such as deductibles, copayments, and coinsurance. You should also review the out-of-pocket maximum for each plan, as this can significantly affect your overall healthcare spending.

To understand the overall Medicare cost, you should factor in the total annual expenses you might incur with various plans. Comparing the costs associated with each available plan will lead you to the one that won't break the bank while ensuring you receive adequate care.

Evaluating Medicare Benefits

Look beyond the basics when evaluating Medicare Benefits. Some Medicare Advantage Plans offer additional perks like gym memberships, transportation services, and preventive care. It’s essential to assess the full range of benefits offered by each plan and determine what’s important for you. The best Medicare Advantage Plans often provide these extra services, enhancing your overall health experience.

Prescription Drug Coverage

Many Medicare Advantage Plans include Prescription Drug Coverage (Part D), which is crucial for those who need medications regularly. Not all plans offer the same formulary (list of covered drugs), so it’s vital to ensure that your prescriptions are covered under the plan you choose. Many people frequently overlook the importance of this aspect, leading to unexpected out-of-pocket costs down the line.

When reviewing plans, be sure to check whether the drugs you’re currently taking are included in the plan's formulary and whether you can maintain your pharmacy of choice or if you’ll have to switch. Understanding the extent of prescription drug coverage offered can make a significant difference in managing your health costs.

Finding the Right Health Plan

Choosing the right health plan can be challenging, especially with so many options available. There are tools available that can help you compare different Medicare Advantage options more easily. Resources like this comprehensive comparison tool can help you visualize differences between plans, allowing you to make an informed decision faster.

Limitations of Medicare Advantage Plans

While Medicare Advantage Plans offer various benefits, they may also have certain limitations. For instance, these plans generally require you to use a network of doctors and hospitals to receive the full benefits. Out-of-network services might cost you more or could be entirely excluded from coverage. Be sure to check the plan’s network and ensure that your preferred healthcare providers are included.

Your Options for Enrolling in a Medicare Advantage Plan

Enrollment for Medicare Advantage Plans typically occurs during the Annual Election Period (AEP), which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage Plan, change from one Advantage Plan to another, or drop your Advantage Plan and return to Original Medicare.

There are also Special Enrollment Periods (SEPs) that allow you to apply for plans outside of the AEP under specific circumstances. It’s essential to remain informed regarding these enrollment windows to ensure you don’t miss the opportunity to select the best plan for your health and financial needs.

Consulting With Professionals

Don’t hesitate to reach out to healthcare professionals or insurance specialists for guidance when considering your options. They can provide insights about different Medicare Advantage Plans, the enrollment process, and may even help you understand the nitty-gritty details of Medicare. A consultation may uncover options you hadn't previously considered for affordable health coverage.

Staying Informed About Plan Changes

One of the essential aspects of managing your Medicare Advantage Plan is staying informed about changes that could affect your coverage. Each year, insurance companies can modify their plans, including benefits, costs, and provider networks. Always review your plan details periodically to ensure that it continues to meet your needs and financial capabilities. For example, be aware of which plans are considered the best Medicare Advantage Plans each year to remain up to date.

Making the Final Decision

Once you’ve done your homework and gathered all the necessary facts, it’s time to make your choice. Remember, the best Health Plan is one that aligns with your personal healthcare needs, budget, and lifestyle. Take your time comparing the various benefits from the different plans available in your area. Ensure you feel comfortable and confident in your decision.

Take Control of Your Health Care

Choosing the right Medicare Advantage Plan is an essential step in taking control of your healthcare journey. The right plan can lead to more opportunities for holistic well-being and peace of mind. As a senior, you deserve to have access to the best healthcare available. By carefully considering your options, you can select a plan tailored to fit your needs and ensure you have the coverage necessary for a healthy, happy retirement.

Conclusion

In conclusion, navigating the world of Medicare can be a daunting task, but it doesn't have to be. By understanding the various plans, the benefits each offer, and the associated costs, you can confidently choose the right Medicare Advantage Plan that works for you. Remember to take your time in making this important decision!

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

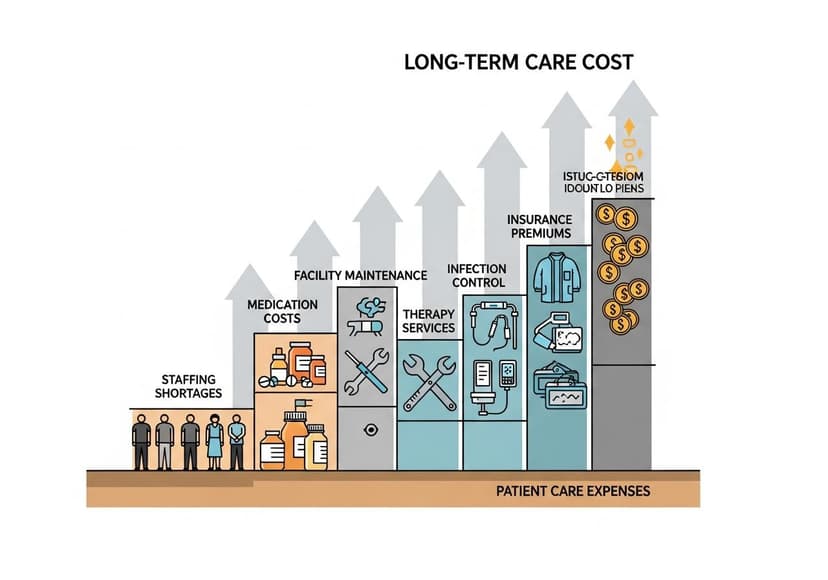

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.