Common Riders For Seniors

Senior insurance riders offer enhanced coverage, addressing specific needs with tailored benefits and added protection for seniors.

Understanding Life Insurance for Seniors

Life insurance is essential for seniors, offering financial peace of mind to loved ones in the event of an unexpected loss. However, traditional life insurance policies may not always provide the specific coverage needed as we age. This is where riders come into play. Riders are add-ons to insurance policies that tailor the coverage to fit individual needs better. As seniors, it’s crucial to explore different riders that can enhance your senior insurance plan.

What Are Riders?

Riders are provisions that allow policyholders to customize their insurance policies by adding extra benefits. For seniors, choosing the right riders can provide added security and peace of mind. Some common riders include long-term care, critical illness, final expense, and more. Each serves a specific purpose, ensuring that your insurance fits your lifestyle and health needs. Always consult with a financial advisor when considering which riders to add to your policy.

Long-Term Care Riders

As we age, the need for extended healthcare services rises. A long-term care rider helps cover the costs associated with home health aides, nursing homes, or other long-term care facilities. This rider can be a lifesaver, as it eases the financial burden on families while ensuring you receive the care you need. Remember, traditional policies often do not cover these costs, making a long-term care rider essential for senior insurance plans.

Critical Illness Riders

Critical illness riders can provide a lump-sum benefit if you are diagnosed with a severe health condition, such as cancer, heart attack, or stroke. This funding can be used for anything from experimental treatments to mortgage payments while recovering. Adding a critical illness rider to your life insurance can alleviate the stress of financial hardship during tough times.

Final Expense Riders

One of the most challenging conversations for many families is planning for end-of-life expenses. A final expense rider covers funeral and burial costs, ensuring your loved ones are not burdened with these expenses. This rider can be an integral part of your overall financial planning, providing a sense of relief and allowing family members to focus on celebrating your life rather than worrying about costs.

Medicare Supplement Insurance

Although Medicare covers many healthcare costs, it doesn’t cover everything. A Medicare supplement plan can help fill those gaps. Adding this to your insurance portfolio is crucial as healthcare expenses can be a significant concern for seniors. It can cover additional services, which ultimately helps maintain a better quality of life while keeping financial worries at bay.

Dental and Vision Insurance

As we age, dental and vision health often requires specialized care. Many basic life insurance policies don’t cover these expenses. That’s where dental insurance and vision insurance come in handy. By adding these riders, you ensure you can access the healthcare you need without crippling costs, preserving your overall health in those vital areas.

Prescription Drug Coverage

Prescription medications can be a significant expense for seniors. A prescription drug coverage rider on your life insurance policy helps ease the financial burden of medications. Medication needs frequently change as we age, so having reliable coverage ensures you can stay healthy without worrying about the cost of necessary prescriptions.

Hospital Indemnity Riders

Hospital stays can wreak havoc on your savings. A hospital indemnity rider provides a fixed cash benefit for each day you're in the hospital, helping offset the costs associated with admission. This rider can provide peace of mind, ensuring that you won’t be left financially vulnerable in the case of a hospitalization.

Cancer Insurance Riders

Many seniors face an increased risk of developing cancer. Having a cancer insurance rider can ease the financial strain of treatments like chemotherapy, radiation, and special medications. This rider offers additional financial assistance that helps cover the costs associated with cancer treatment, allowing you or your loved one to focus on recovery without the heavy burden of financial worries.

Home Healthcare Riders

For many seniors, remaining in their homes is crucial, and home healthcare services make this possible. Adding a rider to your life insurance to cover home healthcare ensures that you can receive assistance while staying in the comfort of your own home. This option can lead to better mental well-being and overall satisfaction during your later years.

The Importance of Life Insurance for Seniors

Life insurance isn’t just a policy—it's a promise to your family. In your golden years, the last thing you want to do is leave your loved ones in financial distress when you pass away. By including various riders like those mentioned, you’re making sure that your policy serves its purpose—to care for your family after you're gone. Ensuring your life insurance has a well-rounded structure is key to protecting your loved ones.

Exploring Your Options

Choosing the right insurance and riders can be complicated, especially with so many options available. It’s best to sit down with a financial advisor who specializes in senior insurance. They can help guide you through the decision-making process and ensure you select the right riders for your personal situation. For detailed information, check out this helpful article to understand better the potential benefits and coverage you need.

Wrap Up

In the end, life insurance is a vital aspect of financial planning for seniors. By leveraging riders like long-term care, critical illness, or home healthcare, you enhance your policy’s capability to meet your unique needs. Be proactive and thoroughly explore your options to provide not just financial relief but also peace of mind for both you and your family. For a comprehensive guide, consider visiting this informative resource on senior insurance riders. Remember, tailoring your policy is about ensuring a stable future for your loved ones.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

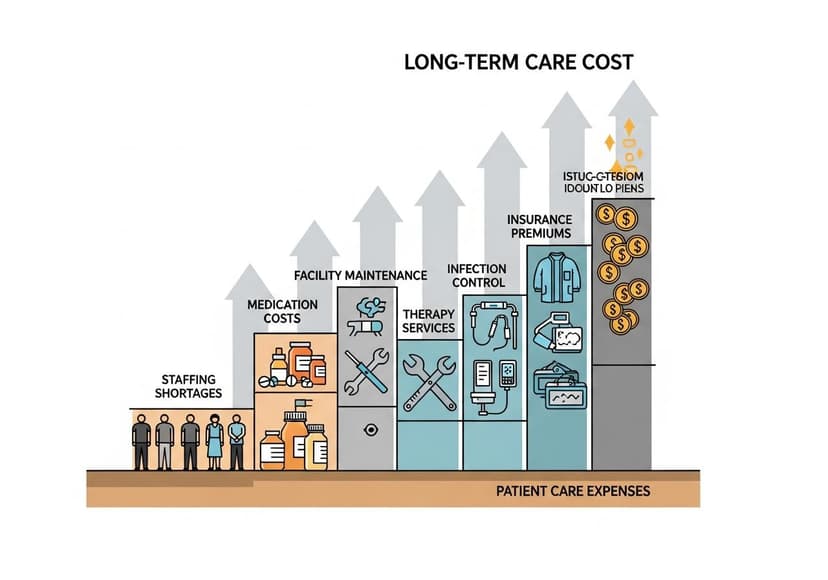

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.