Enrolling In A Medicare Supplement Plan

Seniors can reduce healthcare costs with Medicare Supplement plans, covering gaps in Original Medicare coverage.

Understanding Medicare and Medicare Supplement Plans

Medicare is a federal health insurance program primarily aimed at people aged 65 and over, as well as younger individuals with certain disabilities. It consists of various parts, and although it provides an extensive range of healthcare services, it probably won't cover everything. This is where Medicare Supplement Plans (also known as Medigap Plans) come into play.

These plans help to cover the gaps that original Medicare does not pay for, such as copayments, coinsurance, and deductibles. They are offered by private insurance companies and each plan is standardized by the government.

Medicare Eligibility and Enrollment

To be eligible for Medicare, you typically must be 65 years old or older, a United States citizen, and have worked for at least ten years in a Medicare-covered job. Individuals under 65 may also qualify due to specific disabilities or medical conditions such as End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Enrolling in a Medicare Supplement Plan can be done during the Medicare Open Enrollment period, which generally runs from October 15 to December 7 each year. During this time, beneficiaries can sign up for a Medicare Advantage Plan or switch between plans. However, it's crucial to understand how to enroll in Medicare before considering supplementary plans. You can learn more about it here.

Choosing the Best Medigap Plans

There's a variety of Medigap plans available, each providing different levels of coverage. Some of the most popular options are Medigap Plan G and Medigap Plan F. Plan G is known for its comprehensive coverage, including all coinsurance costs and out-of-pocket expenses, except for the yearly deductible. On the other hand, Plan F offers even broader coverage, including the deductible, but is no longer available to new Medicare beneficiaries after January 1, 2020.

Finding the Best Medigap Plans for your needs might require a bit of research. It's essential to consider factors like monthly premiums, coverage options, and any potential out-of-pocket expenses. The market can be competitive, so compare rates and benefits to find a plan that suits your lifestyle and budget.

Medicare Advantage vs Medigap

When considering your Medicare coverage options, you might stumble upon the terms Medicare Advantage vs Medigap. Understanding the differences between these two types of plans can help you make an informed decision. Medicare Advantage Plans are a type of private health insurance plan that provides an alternative way to receive your Medicare benefits. They often include additional benefits, such as dental and vision coverage, but generally require you to use a specific network of healthcare providers.

Conversely, Medigap policies are designed primarily to fill the gaps in original Medicare. They don’t cover additional services like vision or dental but can significantly reduce out-of-pocket costs for eligible Medicare beneficiaries. If you're still unsure about which plan is right for you, check out this detailed comparison here.

Calculating Medicare Costs

One of the most critical factors in your decision-making process should be understanding your Medicare Cost. Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance), which can involve various out-of-pocket expenses. These costs may include premiums, deductibles, and copayments that can add up quickly.

When selecting a Medigap plan, consider how those costs will play into your financial situation. Each Medigap plan has its pricing structure, and rates can vary based on factors such as location, age, and even your health condition. Be sure to compare your options thoroughly to minimize your overall healthcare costs.

How To Enroll In Medicare Supplement Insurance

Enrolling in Medicare Supplement Insurance is a process that requires several steps. Firstly, make sure you're already enrolled in Medicare Part A and B. The best time to enroll in a Medigap plan is during your Medicare Open Enrollment, which begins on the first day of the month you turn 65 or after you've been on Medicare for 24 months if you qualify due to a disability.

During this period, you have a guaranteed issue right, meaning you cannot be denied coverage based on pre-existing conditions. Once this enrollment period ends, you may face higher premiums or may even be denied coverage altogether. It’s critical to understand these timelines to maximize your healthcare benefits.

Common Myths About Medicare Supplement Plans

There are several myths out there regarding Medicare Supplement Plans that can cause confusion. One common myth is that Medigap plans provide coverage for services that Medicare doesn’t cover. In reality, Medigap plans only help cover costs that are associated with Medicare-covered services.

Another misconception is that if you're enrolled in a Medicare Advantage Plan, you can't purchase a Medigap policy. While this isn't necessarily accurate, it’s essential to understand that you cannot have both at the same time, as per Medicare rules. Familiarizing yourself with accurate information will ensure that you make decisions that positively impact your Medicare coverage.

Final Thoughts on Medicare Supplement Plans

Choosing a Medicare Supplement Plan can be a daunting task, but the advantages often outweigh the drawbacks. While original Medicare provides substantial coverage, a Medigap plan can add an extra layer of financial protection against unexpected healthcare costs.

As you navigate your options, keep in mind important factors like your personal financial situation, healthcare needs, and any specific doctors or networks you want to remain with. Educate yourself on the available plans and premiums and don’t hesitate to reach out for professional help when needed.

With the right knowledge and preparations, enrolling in a Medicare Supplement Plan can be a smooth and beneficial process. For additional tips on choosing the right Medicare Supplement plan, check this resource here.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

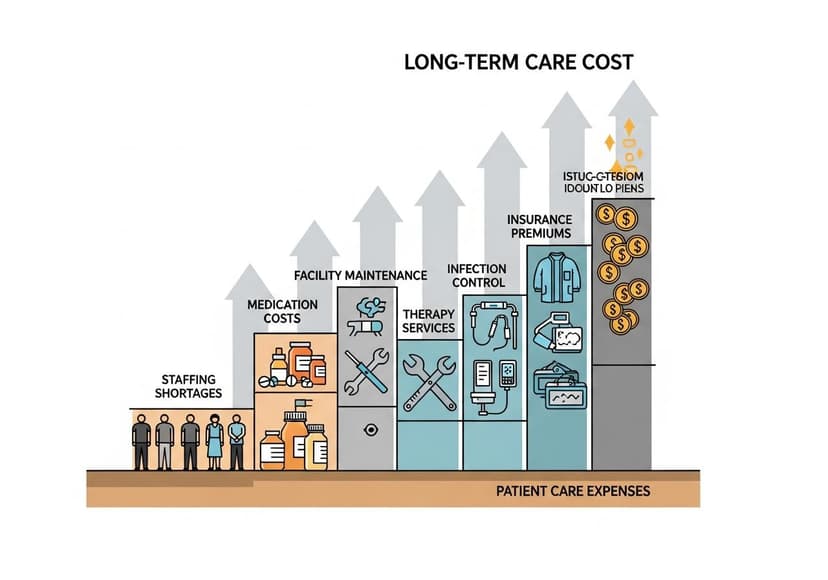

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.