Legal Considerations In Senior Healthcare

Planning for senior healthcare involves key legal aspects, encompassing informed consent, advance directives, and financial arrangements.

As we age, navigating the complexities of senior healthcare can be a daunting task. With numerous legal considerations that come into play, it's vital to stay informed about your options, particularly if you're considering Senior Care for yourself or a loved one. From Estate Planning to Long-term Care, there’s a lot to unpack. This post will highlight key aspects you need to keep in mind while ensuring the best possibilities for your health and financial future.

Understanding Senior Care

Senior Care encompasses a variety of services catered to an aging population. This can include everything from in-home care to assisted living facilities, and even Nursing Homes. Evaluating the right options boils down to assessing individual needs, financial capacity, and understanding the legal ramifications that go along with each choice. As one navigates the landscape of elder care, consulting with an expert in Elder Law can ensure that your decisions align with legal requirements.

The Role of Estate Planning

Estate Planning is crucial for anyone, but it becomes undeniably important as we get older. Essentially, it's about managing your assets and securing a stable future for your family. This includes creating a will, designating beneficiaries, and perhaps most importantly, setting up a Special Needs Trust if you have dependents with disabilities. By consulting legal resources, you can develop a plan that protects your loved ones while making sure they continue to receive any benefits they are entitled to.

Long-term Care Planning

When considering Long-term Care, it’s essential to look at your financial strategies. Many families face the reality of expensive healthcare, which is where Medicaid Planning comes into play. Understanding how to leverage Medicaid effectively can save families from financial strain. It's also helpful to seek guidance from professionals who understand the nuances of these programs to ensure eligibility and benefits are maximized.

Medicare and Medicaid: The Essentials

When transitioning into the world of senior healthcare, you’ll often encounter Medicare and Medicaid. Medicare is a federal health insurance program for those aged 65 and older, while Medicaid assists low-income individuals, including seniors. Familiarizing yourself with the two can be incredibly empowering. For more in-depth information, check out this resource on navigating Medicare and Medicaid benefits.

Nursing Homes and Legal Considerations

Nursing Homes can be a necessary choice for many individuals requiring round-the-clock assistance. However, it’s vital to understand not just the personal implications of entering a nursing home, but also the legal considerations involved. This includes everything from ensuring quality care to understanding the nursing facility's legal obligations. Carefully reviewing contracts and agreements can help avoid potential disputes in the future.

Power of Attorney: What You Need to Know

One of the most valuable tools in senior healthcare is the Power of Attorney. This legal document allows you to designate someone to make decisions on your behalf when you're unable to do so yourself. Particularly in healthcare scenarios, having a designated individual in charge can remove stress and ensure your care preferences are honored. Knowing how to set this up properly can make all the difference.

Advance Directives: Planning for the Future

Advance Directives are documents that express your wishes regarding medical treatment in the event you cannot communicate them. This may include your preferences on life-sustaining treatments and resuscitation efforts. Preparing an advance directive puts your mind at ease while relieving your family from making these difficult decisions during emotional times. It’s a proactive step that can significantly improve care in critical situations.

Guardianship and Conservatorship: Understanding Options

When individuals can no longer manage their affairs, it might be necessary to explore Guardianship or Conservatorship. These legal solutions involve appointing someone to handle personal and financial decisions on behalf of the incapacitated individual. Understanding the differences between the two can help families decide the best option aligned with their loved one’s needs. It’s also worth consulting with an Elder Law attorney for clarity and guidance on these serious matters.

Implementing a Special Needs Trust

If you have a loved one who has special needs, establishing a Special Needs Trust is an invaluable step. This legal arrangement allows you to set aside funds for their care without jeopardizing their eligibility for government benefits. It's essential for families to understand the rules surrounding special needs trusts and how they can be used to secure a stable financial future for dependents with disabilities. For an in-depth guide, consider resources like this one on Senior Healthcare Planning.

Consulting with Legal Experts

As mentioned, the landscape of senior healthcare is complex, and seeking legal advice is essential. Every individual’s circumstances are unique, which is why working with professionals well-versed in Elder Law can provide tailored advice suited to your needs. They can help navigate challenges posed by long-term care, estate planning, and more, ensuring that your legal rights are protected.

Common Misconceptions

Many people carry misconceptions about senior healthcare laws and policies. A prevalent one is that estate planning is something only the wealthy need to think about. With rising healthcare costs, this couldn't be further from the truth. Anyone, regardless of asset level, can benefit from structured planning and legal safeguards. Breaking these myths can help empower more families to take proactive steps.

Final Thoughts

In closing, planning for senior healthcare requires a holistic approach that encompasses legal considerations to fully support you and your loved ones. Whether you're focusing on Medicaid Planning,

For those looking for practical guidance on the matter, I recommend checking out this practical guide to senior healthcare planning that covers essential insights.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

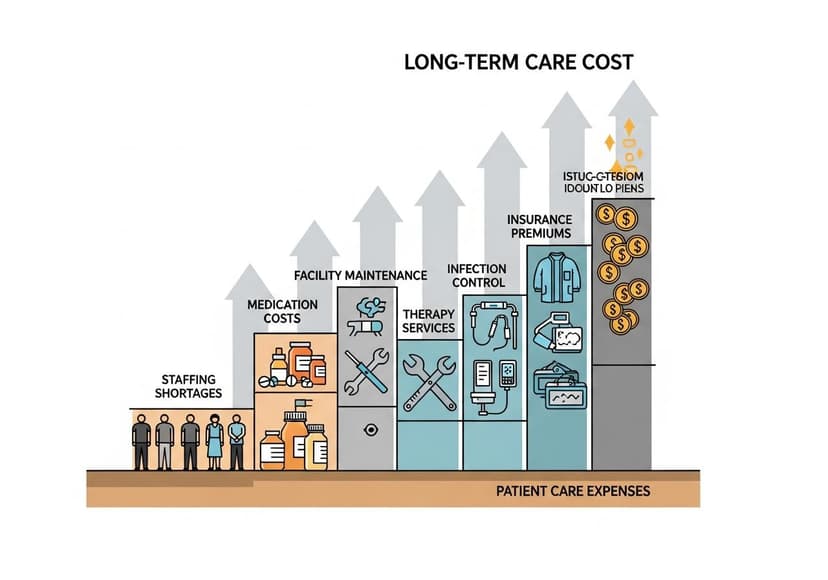

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.