Planning For Long Term Care

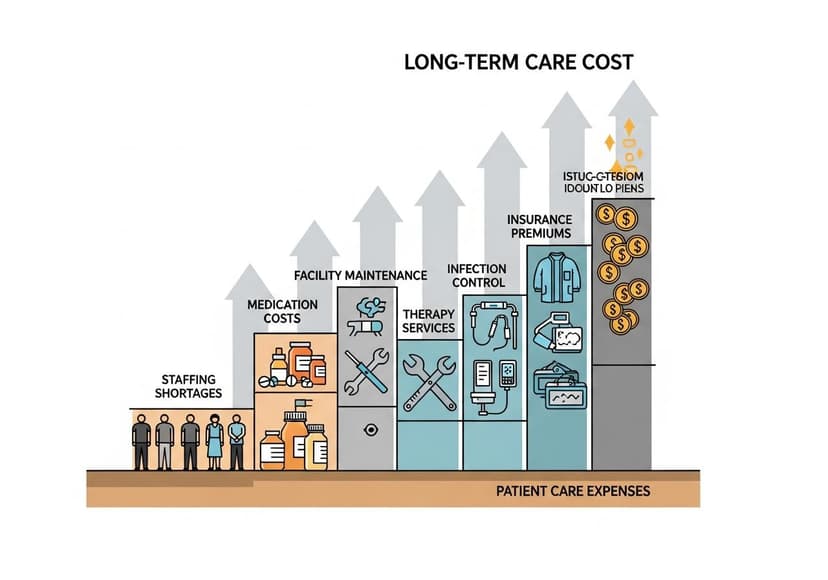

Long term care expenses can be substantial. Financial strategies are crucial to manage these significant costs effectively.

Understanding Chronic Illness and Its Impact

Chronic illness can change the course of our lives in unexpected ways. Conditions like diabetes, heart disease, and dementia require ongoing medical attention and can significantly affect our daily functioning. This reality underscores the importance of Long Term Care Planning. Planning isn't just about preparing for the worst; it’s about ensuring that your quality of life remains high, even when health conditions become more complicated.

Long Term Care and What It Involves

Long term care (LTC) refers to a range of services designed to meet the personal care needs of those with chronic illnesses or disabilities. This can include everything from Home Health Care and Assisted Living facilities to nursing homes. Knowing your options can make a significant difference, both in terms of care quality and overall costs.

Long Term Care Insurance: Is It Worth It?

Long Term Care Insurance can help cover the costs associated with long-term care services. Unfortunately, many people underestimate its importance, often believing that Medicare and Medicaid will suffice. While these programs do offer some support, they often fall short when it comes to providing adequate coverage for long-term care needs. You can explore more on this at Long Term Care Expenses.

Navigating Medicare and Medicaid

Medicare and Medicaid have specific roles when it comes to long-term care. While Medicare may cover short-term care in a nursing home or home health care, it generally does not cover long-term care services. On the other hand, Medicaid can assist with many of these expenses for those with limited income. It's crucial to understand how these programs work and how they can fit into your overall Financial Planning strategy. For further insights, check out Navigating Long Term Care Costs.

The Differences Between Care Options

When planning for long-term care, it's essential to compare your options. Assisted Living provides residents with personal assistance while promoting independence. Meanwhile, nursing homes offer a higher level of medical care and supervision. If you prefer to stay at home, explore Home Health Care, where professionals come to you. Each choice comes with its set of pros and cons, making it vital to evaluate what suits your situation best.

The Role of Geriatric Care Management

If you find yourself overwhelmed by long-term care decisions, Geriatric Care Management might be an avenue worth exploring. These professionals specialize in navigating the complexities of aging care and can help devise a care strategy tailored to your needs. They often address varying conditions, including Dementia Care for those needing specialized help.

Estate Planning: Preparing for Long Term Care Costs

Effective Estate Planning involves more than just distributing your assets after you pass away. It also means preparing for potential long-term care needs. By understanding what your care might entail and planning for those costs, you can alleviate some of the financial burdens on your family. This becomes especially important as you face various unexpected health challenges.

Chronic Illness: The Emotional Toll

The emotional aspects of chronic illness affect not only the patient but also families and caregivers. That’s why having a sound long-term care plan doesn't just focus on financial aspects. It also includes emotional well-being. Joining support groups or seeking therapy may be part of the overall strategy to cope with both mental and emotional challenges associated with chronic illnesses.

Making Informed Decisions: Research is Key

As with anything significant in life, doing your homework is crucial. Understanding your options in terms of care facilities, medical assistance, and financial support can bring peace of mind. Resources such as Understanding Long Term Care can provide you with extra insights on what planning entails, including various service options based on your specific needs.

Communicating with Family

Once you have begun planning for your long-term care, it's essential to communicate your decisions to family members. This conversation can sometimes feel awkward, but it can save you and your loved ones a lot of stress down the road. Discussing your wishes regarding care options, financial resources, and emotional support ensures everyone is on the same page.

Getting Professional Help

Getting professional insight can significantly aid in your planning process. Financial advisors specialize in long-term care options, helping you assess your financial readiness. Similarly, health professionals can provide you with the information you need regarding ongoing care. Having a comprehensive approach, involving experts from various fields, can ease the complexity of your situation.

Monitoring Your Health

As you age, monitoring your health becomes increasingly important. Many chronic illnesses aren't visible at first, and proactive health management can make a difference in your long-term care needs. Regular check-ups and open communication with healthcare providers allow you to adjust your care plans as necessary. This way, you can address issues before they escalate.

Conclusion: Plan for a Better Future

While thinking about long-term care can feel daunting, proactive planning can transform uncertainty into security. Whether you're considering Nursing Home services, Assisted Living arrangements, or home health care, understanding your options and preparing accordingly is vital. By including various resources, from insurance to estate planning, you’re ensuring a better quality of life for yourself as you navigate chronic illness and its implications.

Stay Informed and Engaged

Planning for long-term care will be a continuous journey. As new resources become available, and as your health evolves, it’s advisable to revisit your plans regularly. Stay informed, engaged, and proactive, and you can be prepared for nearly anything that comes your way in the future.

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.