Senior Discounts On Healthcare

Healthcare savings for seniors offer financial relief. Explore options, plans, and reduce costs. Prioritize health, save money.

As the golden years roll around, seniors often find themselves faced with mounting healthcare costs. Fortunately, the good news is that there are numerous discounts and savings opportunities available for seniors when it comes to healthcare. From Senior Health Insurance to Prescription Drug Coverage, discounts can ease the financial burden significantly. Let's explore the landscape of senior healthcare discounts and how they can make a difference in your life.

The Importance of Senior Health Insurance

One of the most crucial pieces of healthcare for seniors is having adequate health coverage. Senior Health Insurance options are tailored specifically for older adults, helping to keep healthcare expenses manageable. This insurance often provides benefits such as doctor visits, hospital stays, and preventive care services at reduced rates.

Understanding Medicare Advantage Plans

Medicare can be a bit complex, but for seniors, understanding Medicare Advantage Plans is essential. These plans offer an alternative to original Medicare, often bundling various healthcare services into one plan. Many of these plans come with added perks like vision and dental coverage, making them a smart choice for those looking to save. Discover more about the options available here.

Prescription Drug Coverage Savings

Medication costs can be one of the most significant expenses for seniors. Fortunately, many health insurance plans offer Prescription Drug Coverage specifically designed to mitigate these costs. Seniors should take the time to compare different plans to find one that not only fits their current needs but also offers the best value. Some plans may even provide access to discounts on generics and brand-name medications, further stretching the dollar.

Long-term Care Insurance: A Wise Investment?

As we age, the likelihood of needing assistance with daily activities increases. Long-term Care Insurance offers coverage for services that traditional health insurance may not, such as home health care and assisted living costs. This can be particularly beneficial for seniors looking to maintain their independence while also ensuring that their care needs are met without straining their finances.

Dental Insurance For Seniors

Oral health is a significant aspect of overall wellness, especially for seniors. However, dental services can be costly without insurance. Dental Insurance For Seniors often includes preventive care, such as routine check-ups and cleanings, and can lead to substantial savings. Many dental plans also offer discounts on other services, making it more affordable for seniors to maintain their dental health.

Enhancing Sight with Vision Insurance For Seniors

As we age, vision problems commonly arise, making access to eye care essential. Vision Insurance For Seniors can cover regular eye exams, glasses, and contact lenses, ensuring that seniors maintain optimal eyesight without overspending. This insurance not only aids in visual health but can lead to better overall quality of life.

The Cost of Hearing Aids For Seniors

Hearing loss is often part of the aging process, and Hearing Aids For Seniors can be a significant expense. Fortunately, many insurance policies now include coverage for hearing aids, providing financial relief. It's crucial to research options and see if any discounts or programs are available that can help offset these costs.

Planning Ahead with Critical Illness Insurance

In today's world, having a safety net is more critical than ever. Critical Illness Insurance helps provide a lump sum payment in case of significant health events. This can assist with living expenses or therapeutic treatments not covered by regular insurance, making it an essential component of a senior’s health strategy.

Securing Peace of Mind with Final Expense Insurance

Planning for the future is a necessity, and Final Expense Insurance can help seniors cover end-of-life expenses, reducing the financial burden on loved ones. Many policies are affordable and can be customized to suit personal needs, providing peace of mind during a challenging time.

Understanding Medigap Policies

For seniors enrolled in Medicare, Medigap Policies offer secondary coverage that fills the gaps in Medicare A and B. This insurance can cover copayments, deductibles, and other expenses, allowing for better financial management when dealing with healthcare costs. It's essential to explore which Medigap policies suit your healthcare needs best.

Supplemental Insurance For Seniors

In addition to traditional Medicare, there are options for Supplemental Insurance For Seniors to enhance coverage. This can include additional dental, vision, and hearing coverage. By researching the options available, seniors can significantly decrease out-of-pocket expenses, prioritizing their health care.

Utilizing Health Savings Accounts

One of the most strategic ways for seniors to manage healthcare expenses is through a Health Savings Account (HSA). An HSA allows individuals to save pre-tax dollars to cover qualified health expenses. This is particularly advantageous for seniors who anticipate ongoing medical costs. By putting money into an HSA, seniors can build a cushion for potential healthcare needs while optimizing their tax savings.

Combining Discounts for Maximum Savings

One of the best strategies for reducing healthcare costs as a senior is to combine various discounts and insurance products. Many seniors often qualify for multiple forms of assistance, from Medicare Advantage Plans to Medigap Policies. By taking a holistic view of their health needs and services, seniors can maximize their savings and improve their overall health outcomes.

Conclusion

Senior discounts on healthcare can pave the way for a healthier and more financially sound retirement. By wisely choosing Senior Health Insurance, exploring available Medicare Advantage Plans, and utilizing add-ons like Dental Insurance For Seniors and Vision Insurance For Seniors, seniors can ensure they are protected. The inclusion of Health Savings Accounts plays a pivotal role in managing the rising costs of healthcare. Explore your options, don't hesitate to ask questions, and find the solutions that are best suited to your unique situation. After all, every little saving counts in maintaining a happy and healthy lifestyle!

Posts Relacionados

Activities In Assisted Living

Engaging activities improve residents' well-being and cognitive function, fostering social connections within assisted living facilities.

Activities In Memory Care Programs

Engaging activities improve cognitive function and enhance quality of life for seniors in memory care settings.

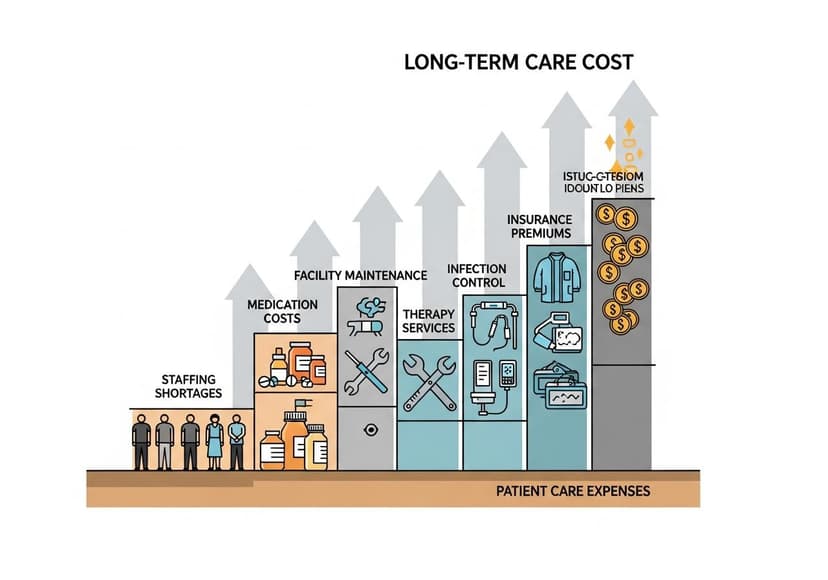

And Facility Challenges

Long-term care facility costs involve significant financial strain, impacting both residents and the healthcare system.